Dardanus Mfalme, popularly known as Dardan King or Darda King has been a key figure in the East African music industry. The multi-talented poet, writer, composer, multi-instrumentalist, and musician has captured the wider imagination of the global audience. Despite his huge reputation as a key figure in the Bongo Flava industry, he has been transitioning into a new genre of music. Dardan King was born in Tanga, Tanzania and his talents would be evident at an early age. What began as piano lessons at the age of 12 would lay the foundation for a successful career. At an early age, Dardan would perform and record choir music and this would be coupled with performances in churches and gospel crusades. Dardan had many projects in high school most of which included playing with the choir as a solo guitarist. However, Dardan would experience his first musical transition when studying in Iowa United States. At his home studio, he began transitioning towards Bongo Flava which was Swahili hip-hop music. In 2005, he released his first album-titled Nimerudi was a hit and it catalyzed his popularity. Nimekubalika 2006, was the artist’s second album that he released in collaboration with Digipixel Studios in Texas in 2006. This is an album that cemented the popularity of the artist in East Africa as “Yiho,” was a music song that dominated the East African TV charts. Nimeshinda 2007 and Nimekamilika 2010 were two more albums that Darda King would release before embarking on another musical transition. Despite the success of Darda King’s venture into Bongo Flava, he would make a key transition into live constructive, and educational music. This transition began in 2011 following the artist’s release of a book titled Nimebadilika 2011, which translates to, I have changed. The release of another book in 2014 titled ”Ninang’atuka 2014," confirmed the changes in his music style, where Darda King explained his reasons for quitting Bongo Flava music and what the audience would expect from his music changes. However, Darda King fans would wait almost a decade for the return of the artist to the music scene. This transition to live and educational music was a significant change for the artist now baptized as Dardanus Mfalme. The music transition was followed by the change of his stage name to Dardan King from Darda King to illustrate a change in his musical taste. Dardan King has grown out of the Bongo Flava phase as his music is more educational. The influence of baptism on his music transition indicates another key progress but also traces his roots to where his music career began. This is a change that the artist foreshadowed in the book released in 2014 and despite a lengthy break from the music scene, he is back with what promises to be another interesting turn in his career. Transformation of one’s music career is quite a common occurrence in the music industry. The return of Dardan King to the music industry is another chapter for the artist that has had so much success outside his native Tanzania. For more info, bio and content visit: https://mfalme.com

CPA Marketing for Beginners

Cost per acquisition, also known as cost per action, pay per acquisition and cost per conversion, is an online advertising pricing model where the advertiser pays for a specified acquisition

What Is SEO / Search Engine Optimization?

All major search engines such as Google, Bing and Yahoo have primary search results, where web pages and other content such as videos or local listings are shown and ranked based on what the search engine considers most relevant to users. Payment isnӴ involved, as it is with paid search ads.

What is Affiliate Marketing

Affiliate marketing is a type of performance-based marketing in which a business rewards one or more affiliates for each visitor or customer brought by the affiliate's own marketing efforts.

What is Digital Marketing

Digital marketing is the marketing of products or services using digital technologies, mainly on the Internet, but also including mobile phones, display advertising, and any other digital medium.

Search engine optimization (SEO)

Search engine optimization (SEO) is the practice of increasing the quantity and quality of traffic to your website through organic search engine results.

Friday, April 28, 2023

Tuesday, April 4, 2023

Why you Contact Wedding Planner Service Provider

A wedding planner is an experienced professional who can help couples plan and organize their wedding day. They specialize in coordinating all aspects of the wedding, including the venue, catering, decor, entertainment, and more.

When it comes to the wedding day, a wedding planner’s

role is to ensure that everything runs smoothly and according to plan. They

oversee the setup and execution of the event, making sure that all vendors are

on schedule and everything is in place.

One of the key benefits of working with a wedding

planner for your wedding day is that they can help you manage any unexpected

situations that may arise. For example, if the caterer is running late or the

flowers haven’t arrived on time, the wedding planner

can quickly come up with a solution to keep the event on track

There are many reasons why you might want to contact a

wedding planner service. Here are some

of the most common:

1. Time

management: Planning a wedding takes a lot of time and effort. If you’re a busy

person or simply don’t have the time to handle all the details, a wedding

planner can help. They’ll take care of everything from booking vendors to

organizing timelines, allowing you to focus on other things.

2. Expertise

and knowledge: Wedding planners are professionals who have a wealth of

knowledge and expertise in planning and coordinating weddings. They can help

you with every aspect of your wedding, from choosing a venue to selecting a

menu, and can offer expert advice and guidance throughout the process.

3. Stress

reduction: Planning a wedding can be stressful, especially if you’re not

familiar with the process. A wedding planner can help alleviate this stress by

taking care of all the details, allowing you to relax and enjoy the process.

4. Budget

management: Weddings can be expensive, and it can be difficult to stay within

your budget without proper planning. A wedding planner can help you stay on

track by providing cost-saving tips and negotiating with vendors on your

behalf.

5. Creative

vision: If you have a specific vision for your wedding but don’t know how to

execute it, a wedding planner can help. They can help you bring your ideas to

life and create a unique and memorable event that reflects your style and

personality.

Overall, contacting a wedding planner service can help

make the wedding planning process smoother, less stressful, and more enjoyable.

They can provide expert guidance and support throughout the process, helping

you create a beautiful and unforgettable wedding day.

We Discuss some wedding dress

Bridal fashion is a constantly evolving industry that is influenced by trends in fashion and culture. While classic bridal styles like white ballgowns and cathedral veils remain popular, many brides today also choose more contemporary and unconventional looks, such as colored dresses, jumpsuits, and separates. Check them out some wedding planners.

Designers and bridal boutiques play a crucial role in the bridal fashion industry, creating and curating a wide range of styles to suit different tastes and budgets. Additionally, many brides opt to work with designers to create custom-made dresses that are tailored to their unique vision and preferences.

Friday, June 18, 2021

Chip-8 Programming Language and Emulator

What is Chip-8 Programming Language?

What is Emulator?

How to write an Emulator?

- Color: Black

- Size: T5 x 60mm

- Manufacturer: Apex Tool Group

- Included Components: Phillips Head Screwdrivers

Game Loop

#include #include // OpenGL graphics and input #include “chip8.h” // Your cpu core implementation chip8 myChip8; int main(int argc, char **argv) { // Set up render system and register input callbacks setupGraphics(); setupInput(); // Initialize the Chip8 system and load the game into the memory myChip8.initialize(); myChip8.loadGame(“pong”); // Emulation loop for(;;) { // Emulate one cycle myChip8.emulateCycle(); // If the draw flag is set, update the screen if(myChip8.drawFlag) drawGraphics(); // Store key press state (Press and Release) myChip8.setKeys(); } return 0; }

Emulation cycle

void chip8::initialize() { // Initialize registers and memory once } void chip8::emulateCycle() { // Fetch Opcode // Decode Opcode // Execute Opcode // Update timers }

CHIP-8 Opcode table

- NNN: address

- NN: 8-bit constant

- N: 4-bit constant

- X and Y: 4-bit register identifier

- PC: Program Counter

- I: 16bit register (For memory address) (Similar to void pointer);

- VN: One of the 16 available variables. N may be 0 to F (hexadecimal);

Installation

Go install github.com/bradford-hamilton/chippy

Optimize SQL database via phpMyAdmin

Overview

If your website is very slow or loading time is high. Then you can Optimize your SQL database tables for fast loading. It is one way of improving website speed. The optimizing function reorganizes the data and database table, which reduces your memory space and improves I/O efficiency.

Today this guide describes How to optimize the database table using phpMyAdmin.

Step 1.

At first, go to your Hosting Panel and log in to your Cpanel. All-time you will choose Best Hosting Server for website. It is the most important part of a website’s speed. If you use shared hosting then you select those hosting providers who will provide High-Speed Service.

Step 2.

When login into your website Cpanel then you go to Database Part and Open your Database in phpMyAdmin

Step 3.

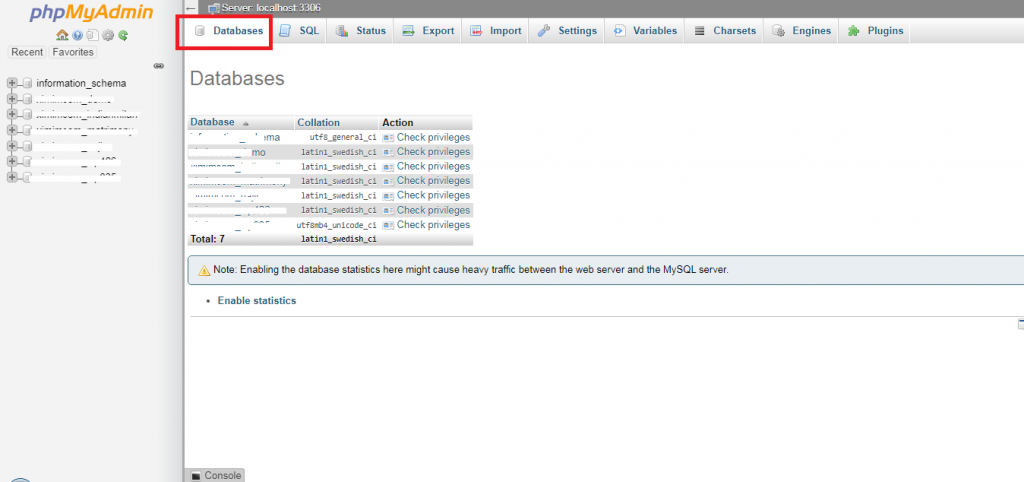

After opening your phpMyAdmin click Databases in the top menu And Select the name of the Database you want to optimize. Always remember that, all-time update your database and remove unused data.

Step 4.

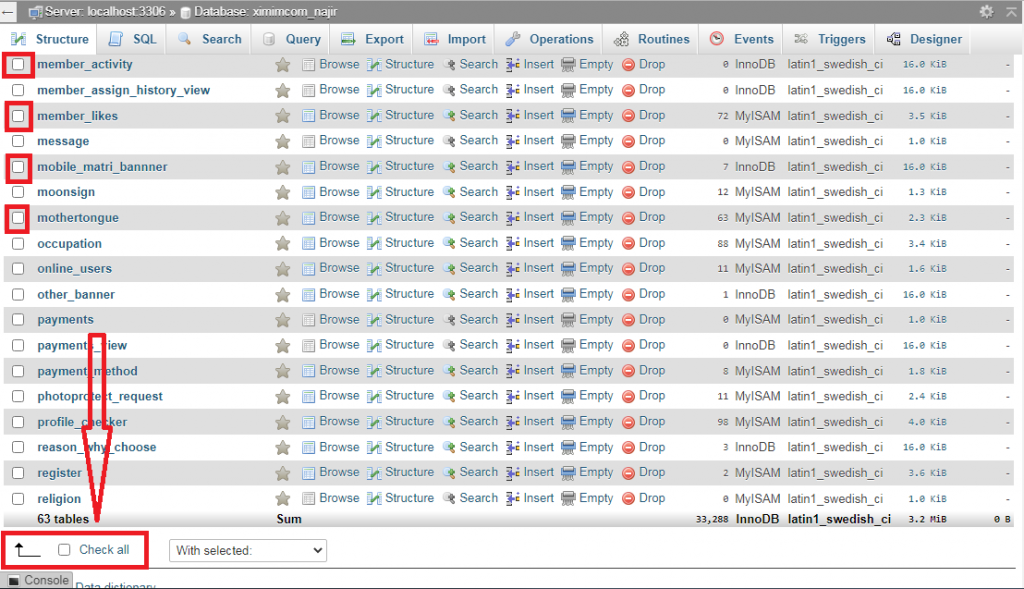

Now, You can select the data table one by one or select the Check all option. If you need few data tables then you select manually one by one.

Step 5.

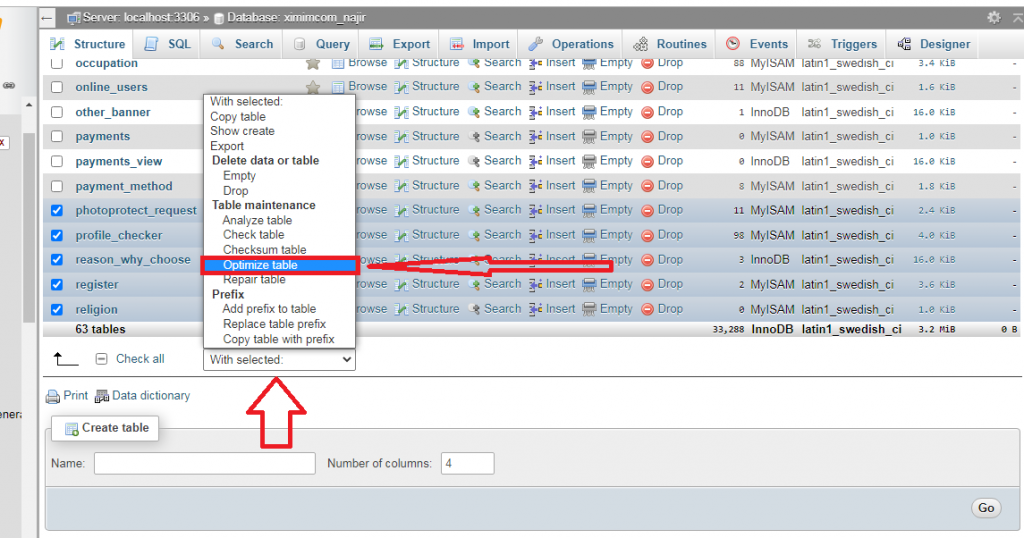

After Select Data Table, Click With Select and select Optimize table from the dropdown option. Be careful that don’t select the drop option from the database.

Step 6.

Now you are done. Your database is now optimized. If you have any question about Domain and Hosting, Please Share in Comment Box.

Wednesday, April 21, 2021

Learn How to Start Online Stock Trading

Learn How to Start Online Stock Trading

Before considering any type of investment or investment strategy, it is important to gain more knowledge about the subject. This stock trading beginner’s guide to online will give you an initial introduction and walk you through the basics so you can feel confident in your options, broking, and business valuation. Also, Today we know How to Start Online Stock Trading.

Choose an Online Broker

If you haven’t opened any brokerage account with a respected online stock brokerage, Then do it. Take the time you need to feel confident that you are choosing the best online stock broker for your situation. When you do research, consider the trading commission fees, how intuitive the application or website is, and any research or educational tools available to customers.

Choose the best brokerage, which ultimately comes down to personal preference, and traders have plenty of options. There are also newcomers who specialize in perfecting the user experience of Robinhood, Webull, and Sophie in their applications.

Research Stocks to Trade

Once you have brokerage you can buy stocks, but you need to know which stocks to buy. If you are new to this type of business, the best place to start may not be with stocks, but

with exchange-traded funds (ETFs).

Research Stocks to Trade

ETFs allow investors to buy a bundle of stocks at once – which can help if you don’t feel confident choosing another company. ETFs built to replicate key indices like Dow, Nasdaq, and S&P 500 are good places to expand your portfolio in the USA stock market.

It is often observed that traders diversify their holdings with assets other than stocks such as bonds as a way to hedge their risk during the stock market downturn.

If you decide to invest in individual stocks, be sure to use some financial analysis ratios to compare a company’s performance with those of its competitors. Successfully selecting individual stocks is very difficult, but extensive comparative analysis can help ensure that you have added the best stocks to your portfolio.

Decide What Kind of Trade Is Right for You

When you want to buy or sell any business asset or stock or you have the option of placing the type of trade order you want. The two most basic types are market orders and limit orders.

Executes market orders immediately for the best price at the moment. Restricted orders do not necessarily take effect immediately, but they do give you more control over the price you pay when selling. You can consider it once you own the stock, This allows you to keep up with the pace of the business and sell automatically as soon as you start the business.

What It’ll Cost You to Trade Stocks

One of the biggest enemies of successful stock trading is cost. They represent your business for payment and security. One such expense is a commission fee, which should be considered when shopping for your brokerages.

If you purchase individual stocks through a broker who does not charge a commission fee, you do not have to incur any expenses. But, when you start trading ETFs, mutual funds, and other types of investments, you need to understand the cost ratio.

These funds are managed by one person who is given a percentage of the fund’s assets each year. So, if the cost ratio of an ETF is 0.1%, that means you will pay 0. 0.10 per year for every 100 100 you invest in an ETF.

These funds are managed by one person who is given a percentage of the fund’s assets each year. So, if the cost ratio of an ETF is 0.1%, that means you will pay 0. 0.10 per year for every 100 100 you invest in an ETF.

In addition to your expenses, risk tolerance should also be considered. A common risk assessment method involves considering a hypothetical scenario so that your investments will suddenly lose 50% of their value. Will you buy more, not buy or sell more after the crash? If you want to buy more, you have aggressive risk tolerance and you will be able to take more risks. If you sell you have conservative risk tolerance and should try to invest relatively safe.

How Trading Stocks Affects Your Tax Bill

In addition to spending, it is important for you to understand the tax rules for each position, especially if you actively trade stocks. The tax you pay on stock gains is known as capital gains tax. Generally, you pay higher capital gains tax when you hold stock for less than one year, and you pay less if you hold stock for more than one year. This tax

the structure is designed to encourage long-term investment.

When you sell stocks for profit, your tax bill will continue to rise, while selling stock for the loss will reduce your tax bill. In order to prevent people from taking advantage of this tax, there are some methods known as “wash sale rules”. Basically, re-entering the same position within 30 days delays the delay in repaying any profit or loss. In other words, if you sell a stock for a loss and buy the same stock one week later, your loss will be taxed. No – it will reach your new position and the number of losses will be after you sell your stock again.

Trade Your First Stock

When you are ready to set up your first trade, transfer money from a bank account to your brokerage account. Once your funds have been disposed of you simply need to choose the business you want to trade, know the type of order, and place the order.

After ordering, check it out to make sure it is implemented. If you use market orders, you should execute them immediately. However, if you use restricted orders, your order will not be executed right now. If you become impatient, you can try to move the price of your limit to the asking price i.e. if you have bought or if it is close to your selling price.

Advanced Stock Trading Strategies

First, when you are ready to set up a trade, transfer money from a bank account to your brokerage account. Remember, once your funds are disposed of, you only need to choose the business you want to trade. To know the order type and place the order.

Make sure that it has been implemented after placing the order. If you use market orders, you should execute them immediately. But if you use a restricted order your order will not be executed right now. You don’t lose patience because you bought it or it is close to your selling price.

Alternatives to Trading Stocks

The only way to get involved in the stock market is to get involved in ETF trading. Also never trade mutual funds, for example, stocks or ETFs, but they allow people to invest in different parts of the market. Robo’s advisors use application-based investment services and the answers to the initial questions automatically make investment decisions. Initially, these were very popular. Because they are easy to understand and come with relatively low

Saturday, March 20, 2021

Best ED Treatment in Bashundhara, Dhaka

● A breakthrough solution for men's Erectile Dysfunction without any side effects and medications.

Best Erectile dysfunction Treatment, also commonly called ED or importance, is the inability to achieve or sustain an erection on repeated occasions. An erection is caused by the interplay of brain, muscles, hormones, blood circulation and nerve impulses. when nerve-and/or bloodstrams are damaged, caused e.g. by alcohol, nicotine or diabetes, this natural flow and the interplay of the mentioned factors are disturbed, an erectile dysfunction can evolve over time.

Low-Intensity Extracorporeal Shockwave Therapy (LI-ESWT), commonly called shockwave therapy, is used to treat erectile dysfunction (ED) caused by vascular problems. Administering low-intensity sound waves has been found to encourage the development of new blood vessels (angiogenesis), and improve the function of smooth muscle and endothelial cells. Shockwaves may also break up micro-plaque and reduce blockages in arteries, enhancing blood flow and accelerating the natural healing process in the penis to improve sexual performance.

The underlying functional cause of erectile dysfunction in many men is an insufficient arterial blood flow in the corpora cavernosa that contains the majority of the blood in a man’s penis during erection. By effectively improving the cavernosal arterial flow, low-intensity extracorporeal shockwave therapy has been clinically proven to improve erectile function and has become an effective and noninvasive treatment for ED. Shockwave therapy is a well-established procedure for promoting healing of soft tissue injuries and old bone fractures, and treating Achilles tendinitis and plantar fasciitis. Its use as a treatment for erectile dysfunction is relatively recent, dating back just a few years. This therapy has been used in Europe for well over fifteen years now with great success. It is Best ED Treatment Center in Dhaka.

When treating ED, a portable device is coated with a lubricating gel and applied directly to the penis. The procedure is painless. Sessions may last from 20 to 30 minutes. Treatment requires one or more sessions per week, over a period of 6–12 weeks, yet the benefits have been shown to last as long as to two years. A follow-up treatment may be scheduled 6 months later. Because this treatment is administered externally, it does not require approval by the US Food & Drug Administration (FDA).

There are no known side effects to the treatment. Shockwave therapy so far is the only current ED treatment modality that offers patients a corrective therapy with long lasting positive results. As compared with these existing traditional treatments being used for erectile dysfunction, LI-ESWT is rather unique.

Thursday, February 25, 2021

Best Physiotherapy Center Bashundhara

Ben-Euro Physiotherapy is a leading physical therapy and rehabilitation Center dedicated to excellence in our comprehensive range of Physiotherapy treatments for acute & chronic musculoskeletal pain and neuro (stroke) rehabilitation. It has been established in 2009 at Bashundhara R/A, Dhaka by a graduate physiotherapist. We have a full professional team to give our maximum using the clinical knowledge and experiences. We also have an internationally certified shockwave practitioner first time in Bangladesh. We are committed to providing evidence-based treatment by using the latest Physiotherapy equipment and manual therapy techniques.

Best Physiotherapy Center in Bashundhara

Our Service

*Neck & Back pain (involving spine)

*Frozen Shoulder/ Calcific Tendinitis of Shoulder

*Tennis Elbow & Golfers Elbow

*Carpal Tunnel Syndrome (CTS)

*Dequarbance Tenosynovitis

*Trigger Fingers

*Greater Trochanteric Syndromes of Hip

*Iliotibial Band Syndromes(ITB)

*Infrapatellar Tendinitis or Jumpers Knee

*Osteoarthritis of the knee

*Calcium Spur & Plantar fasciitis

* Any types of soft tissue injuries

Neurological Conditions:

* Stroke or paralysis

* Bell,s Palsy or Facial palsy

* Parkinson,s Disease

*Any types of nerve injury

Urological Conditions:

* Erectile Dysfunction (ED) of men

*Peyronie,s Disease (PD)

*Chronic pelvic pain syndrome

- Hard Flaccid Syndrome

Please contact us for Best Physiotherapy Center in Bashundhara R/A